COSATU says any VAT hike will hurt the poor, says govt should focus on wealthy

Non-profit organisations, labour and law firms appeared before a joint finance committee meeting which is holding public hearings on the fiscal framework and revenue proposals contained in the budget.

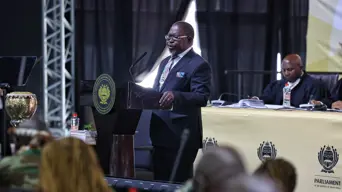

Finance Minister Enoch Godongwana tabled the 2025 budget in the National Assembly in Cape Town on 12 March 2025. Picture: GCIS

CAPE TOWN - Non-profit organisations, labour and law firms have made calls to Parliament to consider their inputs before passing the budget.

The various organisations appeared before a joint finance committee meeting, which is holding public hearings on the fiscal framework and revenue proposals contained in the budget.

Most of the submissions made have rejected the VAT increase proposal of 0.5 percentage points and want different alternatives to be considered, including a wealth tax.

Congress of South African Trade Unions (COSATU) kicked off the public hearings with parliamentary coordinator Matthew Parks maintaining that any VAT increase would hurt the poor, saying government should rather focus on the wealthy.

"Removing pension and medical rebates for top tax brackets, look at the issue of inheritance and estate duties, a general wealth tax and raising company tax on wealthy corporations to really shift the burden away from the poor to the wealthy, who can afford it."

Charles de Wet, a tax expert representing law firm ENS Africa, said that the VAT increase staggered over two years would have far-reaching implications.

"Once we get to 2026, you would have to have different systems and different control accounts dealing with a 15% rate, a 15.5% rate and then a 16% rate. This creates significant opportunity for error and potential penalties and interest associated with that."

The public hearings started with the first fiscal framework and revenue proposals, which have to be processed 16 days after budget day, before reporting to the National Assembly and NCOP, which will decide to accept or amend the fiscal framework.