READ IN FULL: The Budget Speech - 21 May 2025

The budget speech delivered by the Minister of Finance Enoch Godongwana

Finance Minister Enoch Godongwana delivered the national budget for 2025 in the National Assembly

INTRODUCTION

Madam Speaker, a national budget is not merely an accounting exercise measuring what we earn, what we spend and what we borrow as a nation. It is a reflection of the difficult trade-offs needed to balance fiscal sustainability while addressing our developmental goals.

It is unsurprising then that the increase to Value Added Tax (VAT) proposed on March 12 created so much debate. A vital debate no doubt, but one that also created some uncertainty.

There is clarity now: VAT will remain at 15 per cent. This decision reflects our commitment to listen to South Africans, and to all the political parties represented in this House.

Today’s budget has taken these views into account. This is what the past two months have provided: valuable lessons that will inform how we manage the budget process moving forward. The reality, however, is that the decision to do away with the VAT increase, without a viable alternative source of revenue, significantly reduced our ability to fund additional government programmes and projects to the extent we had deemed necessary.

Nevertheless, this budget supports sustainable finances, the social wage and investments in economic growth. This is not an austerity budget. It increases non-interest expenditure by an average of 5.4 per cent over three years. In real terms, this is 0.8 per cent growth.

It is also a redistributive budget. It directs 61 cents of every rand of consolidated, non-interest expenditure towards the social wage. This is money that will be spent to fund free basic services like electricity, water, education, healthcare, affordable housing, as well as social grants for those in need.

This budget invests over R1 trillion in critical infrastructure to lift economic growth prospects and improve access to basic services. Madam Speaker, this is done without compromising the fiscal strategy of sustainable public finances.

We have achieved this difficult balance by reducing additional spending over the medium term by R68 billion. These reductions are primarily aimed at provisional allocations not yet assigned to votes. Simply put, this means baseline allocations across all spheres of government remain largely unchanged. Instead, the size of the proposed increases to allocations is reduced, in line with what we can afford.

Our focus going forward is threefold: balancing the budget through spending efficiencies, strengthening revenue collection, and giving expression to the Medium-Term Development Plan. This undertaking is not insurmountable if we work together, stay focused, and persevere to chart a better course for our economy and our people.

ECONOMIC OUTLOOK

Turning to the economic outlook. Madam Speaker, much has changed since our last appearance in this House.

The most troubling changes are the global economic developments which have, in the short space of two months, already had a significant impact on the domestic economic outlook. GLOBAL The global economy is facing heightened trade tensions and elevated policy uncertainty with worrying economic consequences.

The International Monetary Fund now projects global growth at 2.8 per cent in 2025. This is 0.5 percentage points lower than the January estimate. Similarly, global trade is projected at 1.7 per cent in 2025, which is also much lower than the January estimate. At the same time, inflation expectations are now above central bank targets in many advanced and emerging market economies. And new trade barriers may raise inflation and prolong the cycle of higher interest rates.

DOMESTIC

Turning to the domestic outlook. Madam Speaker, as a small, open economy, South Africa is dependent on global trade and financial inflows.

This makes us particularly exposed to the global economic developments that I have just outlined. As a result, we now estimate real GDP to grow at 1.4 per cent in 2025. This is lower than the 1.9 per cent we projected in March.

Over the next two years, we project real GDP growth to rise moderately, to 1.6 per cent in 2026 and 1.8 per cent in 2027. Looking further ahead, the risks to the outlook remain elevated. These include the worsening global outlook, weaker-than-expected growth in the fourth quarter of 2024, the persistence of logistics constraints and higher borrowing costs.

These developments are a vivid reminder that we must urgently turn the tide on our economic prospects and get our fiscal affairs in order. Faster, inclusive growth that creates jobs is the only path towards a more prosperous South Africa. Attaining this growth must be our national obsession. We all have a stake and a responsibility to work towards this goal.

FOSTERING FASTER INCLUSIVE GROWTH

Honorable members, our strategy for faster growth, and to shield our country from the worst impacts of an increasingly uncertain global environment, remains anchored on four pillars:

• Maintaining macroeconomic stability,

• Implementing structural reforms,

• Improving state capability, and

• Accelerating infrastructure investment.

Madame Speaker, let me demonstrate how this budget reflects this strategy. First, maintaining macroeconomic stability promotes low and stable inflation, and lower interest rates while enhancing the country's ability to withstand external shocks.

In turn, this creates a conducive environment for investment, savings and job creation.

FISCAL STRATEGY

Honourable members, prudent fiscal policy is a key component of maintaining macroeconomic stability.

The balanced fiscal strategy we are presenting today reflects this. It stabilises debt as a percentage of GDP, achieves a primary surplus, expands infrastructure investment and supports the social wage.

In 2025/26, government debt is projected to stabilize at 77.4 per cent of GDP. While this is 1.2 per cent higher than projected in the March 12 budget, it is mainly due to lower nominal GDP. The main budget deficit decreases by R8 billion over the MTEF, compared to our estimates in March.

This narrower deficit is enabled by the steadily expanding primary surplus. By 2027/28, the primary surplus will grow from an estimated 0.8 per cent of GDP in this financial year to 2.1 per cent.

Madam Speaker, a growing primary surplus means that our revenue will continue to be larger than our non-interest expenditure over the next three years. This contributes to lowering our gross borrowing requirements, resulting in lower debt and lower debt service costs over time.

However, debt service costs remain high, amounting to more than R1.3 trillion over the next three years. Put differently, this means in 2025/26 alone we are spending around R1.2 billion per day to service our debt.

This is more than what we spend on frontline services such as health, the police and basic education. We must maintain our efforts to reverse this trend and prevent the cost of debt from robbing us of resources that could otherwise be spent on pressing social needs, or to invest in growth. This fiscal strategy is how we will drive down the debt to GDP ratio, slow the growth in debt service costs and rebuild our fiscal buffers.

And in this way shield ourselves from an increasingly uncertain and unpredictable external environment. To address the persistent fiscal imbalances in the medium to long term, we have published a discussion document on fiscal anchors.

The consultations with a range of stakeholders and experts on this paper are ongoing.

STRUCTURAL REFORMS

Madam Speaker, a bigger, faster-growing economy, and the larger fiscal resources that come with it, are the key to building up the fiscal room we need to meet more of our developmental goals. The second pillar of the economic growth strategy is in our continued commitment to implement growth enhancing structural reforms. Through the first phase of Operation Vulindlela, bold and far-reaching reforms were implemented in the network sectors and the visa regime.

As a result, numerous economic bottlenecks have eased, new investments unlocked, and the growth potential of the economy enabled. Yet the economy still faces constraints.

During the launch of the second phase of OV two weeks ago, the President aptly pointed out that, and I quote: “Our economy needs to grow much faster to create jobs that we need and to achieve prosperity for all”.

The second phase will therefore focus on the following areas:

• Seeing-through existing reforms in energy, water, logistics and in the visa regime.

• Improving the performance of local government. This includes professionalising utilities, appointing suitably qualified people to senior positions, and reviewing the local government fiscal framework.

• Harnessing digital transformation, in order to drive the adoption of digital technologies in government and build digital public infrastructure for use by all South Africans.

• Addressing the apartheid legacy of spatial inequality.

Reforms will include changes to housing policy and accelerating the release of publicly owned land and buildings. This will also entail clearing the backlog of title deeds for affordable housing, and a comprehresive regulatory review aimed at removing barriers to the development of low-cost housing. Tackling these structural constraints will ensure that impediments to faster growth are removed.

REVENUE PROPOSALS

Madam Speaker, the budget process this year has been contentious, mainly due to the tax proposals announced on March 12.

I want to assure the public, and this House, that the aim of the March 12 budget was to balance the necessity of growing the economy, with the equally urgent need to repair and rebuild our public finances.

This remains our goal. And as I have already said, the proposed increases in the VAT rate in 2025/26 and 2026/27 have been dropped. As a result, the expansion of the zero-rated basket, which was included to cushion poorer households from the VAT rate increase, falls away. Madam Speaker, compared to the March estimates, tax revenue projections have been revised down by R61.9 billion over the three years, This reflects the reversal of VAT increase and the much weaker economic outlook.

In this difficult environment, it remains vital that we still take actions to increase revenue to protect and bolster frontline services, while expanding infrastructure investments to drive economic activity. To this end, this budget proposes an inflation-linked increase to the general fuel levy.

For the 2025/26 fiscal year, this is the only new tax proposal that I am announcing. This is the first fuel levy increase in three years. It means from the fourth of June this year, the general fuel levy will increase by 16 cents per litre for petrol, and by 15 cents per litre for diesel. Unfortunately, this tax measure alone will not close the fiscal gap over the medium term. The 2026 Budget will therefore need to propose new tax measures, aimed at raising R20 billion.

We have allocated an additional R7.5 billion over the MTEF, to increase the effectiveness of the South African Revenue Service in collecting more revenue. Part of this allocation will be used to increase collections from debts owed to the fiscus. SARS has indicated that this could raise between R20 billion to R50 billion in additional revenue per year. Another part of the additional allocation to SARS will be used to improve modernisation.

This will include targeting illicit trade in tobacco and other areas, which should boost revenue over the medium term. As SARS utilises this investment to raise additional revenue, which I believe can be at least R35 billion, the R20 billion to close the current revenue gap will not have to be raised through taxes.

Madam Speaker, let me call on every South African, be they individuals, small business operators or large corporates, to honour their tax obligations and contribute to building a better and more equitable nation.

To all the taxpayers that continue to pay their taxes, thank you. We do not take this for granted. As a government, we know that we must earn the taxpayer’s trust every day, by spending public money with care and ensuring that every rand collected is spent on its intended purpose.

We recognise the urgent need to do more to achieve this goal. We are not deaf to the public’s concern about wasteful and inefficient expenditure. Our commitment to collect taxes must be matched by better efficiency in how that money is spent. It must be matched by much stricter oversight that quickly identifies problems and provides timely solutions when things go wrong.

SPENDING PRIORITIES

Honourable Speaker, Members of Parliament, and fellow South Africans, before I continue, allow me a moment to share with you an open letter from a young medical student, Sarah Stein from UCT. I have read and reread the letter since it was published on 7 May.

The extract of the letter I want to share may be disturbing to some, but perhaps familiar to many of you. Too many. The situation this young doctor describes, of the state of our public hospitals, and the emotional toll of working day after day without the basic resources necessary to help people in need, is the heartbreaking reality that this budget hopes to address.

It is the reality that all of our efforts, as political parties, and as a government, must be concerned with, above all else.

Part of the letter reads: Working in a public hospital with way too few resources punches you in the gut every day. It’s not just the trauma of seeing your patient die — it’s having no gloves in a delivery room; no alcohol swabs to clean wounds; and knowing that nurses stop at the shop on their way to work to buy their own gloves and masks because the clinic has run out. Where waiting times for a scan are months long and surgery delays needlessly let disease progress to the point of being inoperable.

It’s the limited beds in high care that mean doctors are regularly forced to decide whose life is worth saving more because there’s only space for one.

Madam Speaker, it is for this reason that the budget maintains the expenditure trajectory presented in the March 12 budget. Addressing the persistent spending pressures to restore critical frontline services and invest in infrastructure is critical for improving access to basic services and lifting economic prospects.

As a result, total allocated spending excluding interest will amount to R6.69 trillion over the medium term. There is also proposed additional spending of R180.1 billion. This is lower than the R232.6 billion proposed during the March 12 budget.

A breakdown of the sector allocations is as follows: The provincial education sector baseline over the 2025 MTEF is R1.04 trillion, and R9.5 billion will be added over the medium term to keep teachers in classrooms and hire more staff.

An additional R10 billion has been added to the baseline as announced during the March 12 budget to expand access to early education is kept unchanged.

This will increase the ECD subsidy from R17 per child per day to R24. The extra funding will also support increased access to ECD for 700,000 more children, up to the age of five years. The provincial health sector budget is R845 billion over the medium term. This budget will be increased by R20.8 billion over three years to employ 800 post-community service doctors and essential goods and services and reduction of accruals. This increase will also assist the sector in addressing personnel budget pressures.

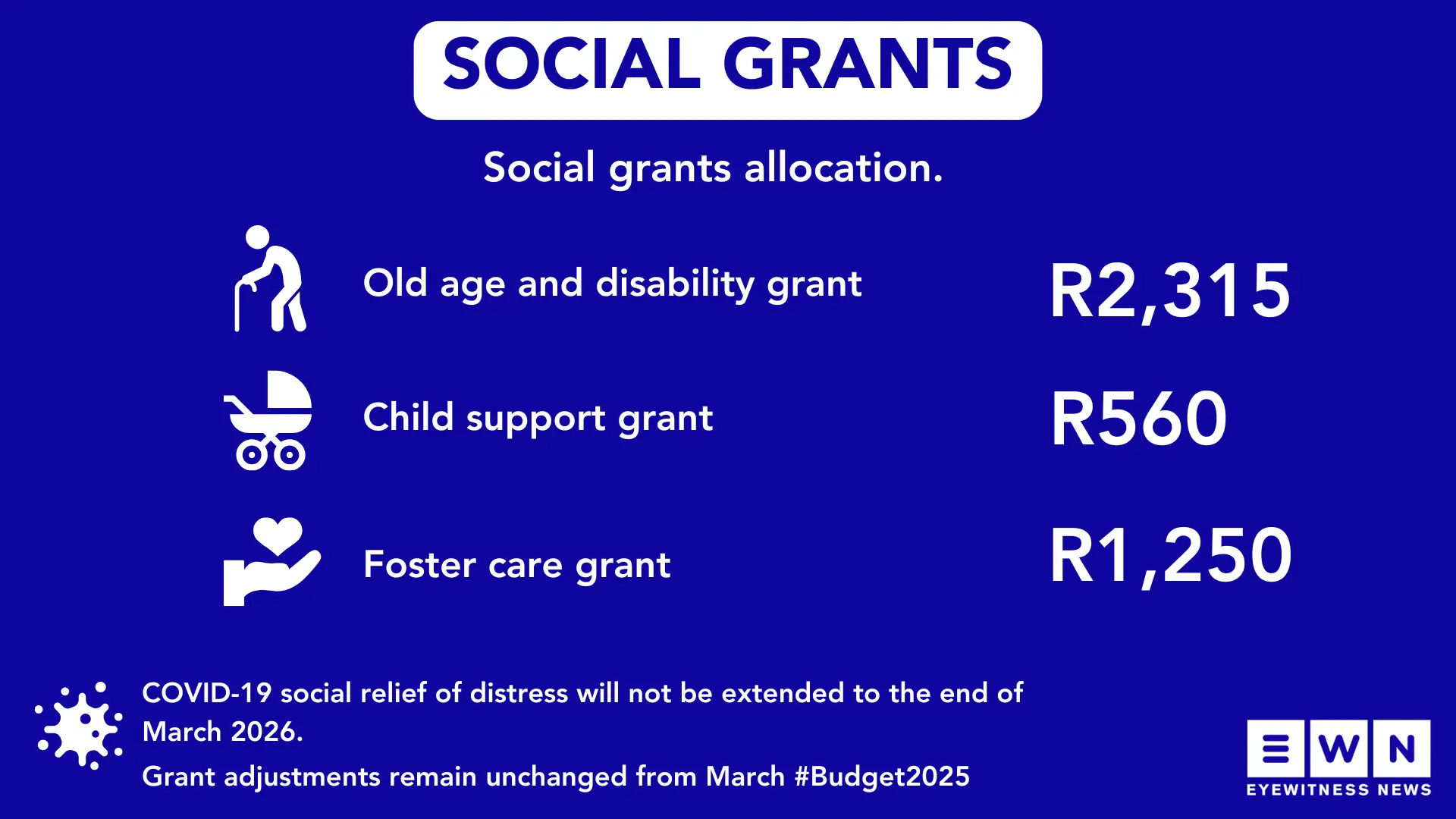

From April 2025, the old age grant increased by R120 to R2,310 and is set to increase by an additional R10 to R2,320 in October, as originally announced in March. The COVID-19 social relief of distress will be extended to the end of March 2026. Government is actively exploring various options to better integrate this grant with employment opportunities.

This includes considering a job-seeker allowance and other measures, as part of the review of Active Labour Market Programmes. Our goal is to not only provide immediate relief. It is also to create pathways to employment, empowering our citizens to build better futures for themselves and their families.

We are also reconfiguring funding for the troop deployment to the Democratic Republic of the Congo. This is in light of the announcement of South Africa's phased withdrawal from the East African country. In this regard, the R5 billion we had proposed to allocate to the Department of Defence for its participation in the SADC mission in the DRC is reduced. But the allocation for 2025/26 has been increased from R1.8 billion to R3 billion. This will cover the immediate costs of an orderly and safe withdrawal of our troops and mission equipment.

Madam Speaker, R1.4 billion is allocated to support the preparations for the upcoming local elections. R885 million of the allocation is for the Independent Electoral Commission and R550 million for the South African Police Service and the South African National Defence Force to maintain public order. This investment contributes to upholding the democratic processes and ensuring that every South African can exercise their right to vote in a safe and secure environment.

This budget also retains the provisional allocations for early retirement, allocations for PRASA and the municipal trading entity reforms announced before, but at a slightly lower level than anticipated in the March 12 budget.

Madam Speaker, the spending choices we are proposing today demonstrate the government’s determination to bolster the state capability needed to deliver quality, reliable and sustainable core services. This is what pillar three of the economic growth strategy is about.

Despite the additional allocations we have made here, there are other long-standing spending pressures that persist but cannot be funded within the current envelope.

This is the nature of policy trade-offs: prioritising what we can do now and what we must postpone and spend on later when our revenue allows. The spending pressures that may require funding later this year, include:

• The withdrawal of the President's Emergency Plan for AIDS Relief (PEPFAR) funding, particularly through USAID.

• Infrastructure projects in the Budget Facility for Infrastructure (BFI) and the Passenger Rail Agency of South Africa (PRASA) rolling stock fleet renewal programme.

• Accommodating population changes that impact on the provincial equitable share allocations.

• Strengthening capabilities in the Office of the Chief Justice and Statistics South Africa. • Political party funding and infrastructure provision for royal houses; and

• The National Social Dialogue. Madam Speaker, the government will also consider government guarantee support to Transnet, to enable the entity to refinance maturing debt, and to enable the execution of its capital investment programme.

SPENDING EFFICIENCIES

Honourable members, when an economy underperforms, as ours has over the last decade, it generates less tax revenue while requiring increased social spending, widening budget deficits and accelerating debt accumulation. To be successful, our strategy of maintaining fiscal discipline while investing in growth demands that we prioritise high-impact expenditures. These are expenditures that deliver economic returns while eliminating inefficiencies, wastage and leakage that too often plague government’s spending.

To tackle this, the National Treasury has undertaken expenditure reviews looking at more than R300 billion in government spending since 2013, with the aim of identifying duplications, waste and inefficiencies. We found potential savings of R37.5 billion over time through improved oversight and operational changes through these reviews.

Going forward, underperforming programmes will be closed as the 2026 MTEF budget process undergoes redesign. New reforms will target infrastructure planning and implementation across provinces and municipalities. A data-driven approach to detecting payroll irregularities will replace the more costly method of using censuses. This initiative will cross-reference administrative datasets to identify ghost workers and other anomalies across government departments.

Part of the goal of these initiatives is to also remove the regulatory burden on business. Madam Speaker, to be successful, not just technical solutions are required. Sustained political backing, at the highest levels, is needed to overcome departmental resistance and to protect whistleblowers who expose irregularities and wastage. I am happy to say that this political backing has already come from President Cyril Ramaphosa, Deputy President Pau Mashatile, as well as my Cabinet colleagues.

The President has also undertaken to establish a committee between the Presidency and Treasury to identify wasteful, inefficient and underperforming programmes. I call on Ministers, MECs, DGs, HoDs and every official responsible for public funds to embrace these efforts and play their part.

DIVISION OF REVENUE

Madam Speaker, the division of nationally raised revenue will see R2.4 trillion of total non-interest spending allocated to provinces over the medium term. Municipalities will receive R552.7 billion over the same period. The split addresses the fiscal realities faced by provinces and local governments.

The allocations will fund increases in the cost of bulk water and electricity costs provided for free to needy households. In 2025/26, 83 per cent of the local government equitable share provides a free basic services package of R610 per month to 11.2 million poor households.

Honourable members, this package of free municipal services continues to be a key tool for reducing poverty and inequality, raising living standards and facilitating access to greater economic opportunities. The reality is that sustainable local government finance does not depend merely on enforcement mechanisms, but on delivering genuine value to communities.

Declining revenue collection rates are often a function of the quality of the services. Municipalities must recognise that quality service delivery is not just a constitutional obligation but also the cornerstone of their own financial viability.

FIGHTING CORRUPTION

Tackling corruption remains a major priority for all arms of government. We are making progress in pushing back against actions that compromise our national interests. In addressing the scourge of corruption, the National Prosecuting Authority has, through its Asset Forfeiture Unit (AFU) adopted a broader and aggressive anti-corruption strategy that has yielded financial injection to the fiscus. In the past five years the AFU has recovered over R5 billion paid into the victims of crime and Criminal Asset Recovery Account (CARA). With regards to state capture related cases, the AFU obtained freezing orders amounting to R14.2 billion with R8 billion recovered and paid to the CARA.

INFRASTRUCTURE

Madam Speaker, quality infrastructure investment expands the productive capacity of the economy and responds to the diverse needs of the citizens. Infrastructure is also a rich source of jobs, in construction, engineering, and related industries across a range of skill levels. It is for these reasons that infrastructure is the fourth pillar of the growth strategy. And this budget demonstrates our resolve to change the composition of spending from consumption to investment. Allocations towards capital payments remain the fastest-growing area of spending by economic classification. Public infrastructure spending over three years will exceed the R1 trillion mark.

This spending will focus on maintaining and repairing existing infrastructure, building new infrastructure, and acquiring equipment and machinery. It will focus on three sectors: transport and logistics; energy and water and sanitation. Of the R402 billion for transport and logistics, R93.1 billion is for the South African National Roads Agency (SANRAL) to keep the 24,000-kilometer national road network in active maintenance and rehabilitation.

R53.1 billion is for the maintenance and refurbishment of provincial roads. These investments will maintain our extensive road network in good condition allowing easy access and movement of freight and people within the country and beyond. R66.3 billion is allocated to PRASA, out of which R18.2 billion is for the rolling stock fleet renewal programme and R12.3 billion is provisionally allocated for the renewal of the signaling system. The spending will sustain progress in rebuilding the infrastructure to provide affordable commuter rail services.

This will enable PRASA to increase passenger trips from 60 million in 2024/25 to 186 million by the end of the MTEF period. Access to safe, reliable and affordable commuter service is critical for low-income earners who spend more than 50 per cent of their income on transport. The energy sector will invest R219.2 billion on strengthening the electricity supply network, from generation to transmission and distribution. This includes investments in renewable energy projects which continue to contribute to stabilising the power supply resulting in reduced loadshedding.

Efforts to connect more renewable energy projects to the grid and expand the transmission network through a multi-line transmission package remain on track. The water and sanitation sector will spend R156.3 billion on expanding our water resource and service infrastructure including dams, bulk infrastructure to service mines, factories and farms. Honourable members, maintenance is important to prolong the life of our infrastructure assets, in addition to ensuring that infrastructure services are reliable and not unnecessarily interrupted.

This is the reason our budgets emphasise this aspect in addition to building new infrastructure. To further support infrastructure delivery and improve spending efficiency, the National Treasury continues to implement reforms that will facilitate greater private sector participation in public infrastructure.

PUBLIC-PRIVATE PARTNERSHIPS

The new regulations for public-private partnerships (PPPs) were gazetted earlier this year and will take effect next month. These will reduce the procedural complexity of undertaking PPPs, increasing the deal flow and allowing government to leverage its limited resources to fast-track infrastructure provision. The National Treasury has developed enabling guidelines and frameworks to support the new regulations. Specifically, the unsolicited proposals framework will create clear rules for managing proposals from the private sector.

And the framework for fiscal commitments and contingent liabilities will strengthen fiscal risk governance. These guidelines and frameworks will be published in the next few weeks. The recently established private sector participation unit of the Department of Transport and Transnet are making progress in engaging the market on PSP projects. The PSPs will resolve and improve some of the critical logistic bottlenecks in the rail and port networks. In March, a request for information was issued for the ore, chrome, coal and manganese lines. In April, a request for qualification was issued for the establishment of an independent rolling stock leasing company.

BUDGET FACILITY FOR INFRASTRUCTURE

Madam Speaker, the Budget Facility for Infrastructure (BFI) has been effective in supporting quality investments. It does so by reviewing proposals for feasibility, viability and cost effectiveness. To date, R52.9 billion in additional funding has been unlocked through this process. To scale up the success, the BFI has been reconfigured to accept proposals quarterly rather than annually.

ALTERNATIVE FINANCING ARRANGEMENTS

In this regard, I am pleased to confirm that the process of issuing our first infrastructure bond in 2025/26 remains intact. We are also exploring alternative financing instruments to allow pension funds, commercial banks, development banks and international financial institutions to participate in financing our infrastructure plans. These reforms, Madam Speaker, are how we plan to leverage infrastructure investment to ease supply side constraints to the economy and improve access to social services the people get.

CONCLUSION

Honourable members today is about delivering on the hope for a better life and a better future. It is an attempt to meet our shared goals of redistribution, redress and structural transformation.

This budget supports economic activity while raising future economic prospects, directs spending towards the social wage, and invests in state capability and critical infrastructure. All the while promoting fiscal sustainability, so future generations are not burdened by the decisions we make today. We are not there yet. But I believe there is consensus in this House and around the country that this is the destination we need to strive for.

The recent events have shown us that political debate is part of any vibrant democracy, and that this is not about differences on these goals, but about how they can be achieved. The debate and negotiations have deepened our understanding of policy trade-offs and institutional processes, while giving citizens unprecedented visibility into our democracy's evolution.

Negotiation, debate and comprise, as we have seen unfold over the last weeks, has been a necessary, if sometimes painful investment in the productivity of future government reform in the new political environment. We have all gained a better, deeper appreciation of each other’s policy positions and which trade offs each of us is willing to contemplate. As parliamentarians, we have been forced to gain closer knowledge of the various institutional processes that govern the budget cycle and its passing into law. The public has had a front-row seat to the growing pains of a vibrant and committed democracy.

This is a good thing. Our journey toward national prosperity belongs to every South African. Speaker, as I close, allow me to express my gratitude to the President and Deputy President in absentia for the wisdom of their counsel and the calm of their leadership. Our country is in safe hands!

My appreciation also goes to the two Deputy Ministers of Finance and the National Treasury team led by the Director-General. They have helped to share the tremendous workload and as they say, “many hands make light work.” Thank you to the Commissioner of the South African Revenue Service and the Governor of the South African Reserve Bank for the care and commitment they have applied to leading these two key institutions.

To my Cabinet colleagues, the Ministers’ Committee on the Budget, and the Budget Council, thank you for always standing ready to think through the toughest choices and chart a path forward in the interests of the country.

Thank you to the Chairperson and Commissioners of the Financial and Fiscal Commission for their valuable input. To the Parliamentary Committees of Finance, Appropriations and Public Accounts, I express my sincere appreciation.

To my beloved wife and family, your patience and unwavering support have sustained me through each challenge. Thank you for walking this path with me. Lastly, thank you to South African people who continue to entrust their aspirations to us.