Kganyago: 'Soft landing' more likely after 'worst inflation surge in a generation'

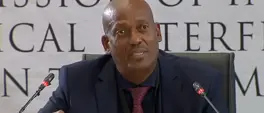

Mongezi Koko

19 September 2024 | 16:16The central bank announced a 25-basis point reduction in the repo rate on Thursday, bringing the rate down to 8%.

JOHANNESBURG - Several factors contributed to Thursday’s repo rate cut.

In a widely anticipated move, the South African Reserve Bank’s Monetary Policy Committee cut the repo rate for the first time since the COVID-19 pandemic in 2020.

READ: SARB's MPC announces first repo rate cut in 4 years

The central bank announced a 25-basis point reduction on Thursday, bringing the rate down to 8%.

#RepoRate has been cut for the first time in 4 years. pic.twitter.com/wxGCPTrb5D

— EWN Reporter (@ewnreporter) September 19, 2024

Reserve Bank Governor, Lesetja Kganyago explained: "In discussing the stance, MPC members considered an unchanged stance, a 25-basis point cut, and a 50-basis point cut. The MPC ultimately reached consensus on 25 basis points, agreeing that a less restrictive stance was consistent with sustainably lower inflation over the medium term.”

While acknowledging ongoing risks, Kganyago noted that global conditions were becoming more favourable.

"A soft landing is looking more likely, after the worst inflation surge in a generation, but it is not inevitable. The financial market volatility of early August was a reminder of the fragilities and uncertainties in the system."

Get the whole picture 💡

Take a look at the topic timeline for all related articles.