If take-home pay in SA is increasing, why doesn't it feel like there's more money?

Paula Luckhoff

22 August 2024 | 18:39The BankservAfrica Take-home Pay Index shows a 'significant' improvement in July.

Stephen Grootes gets more detail from economist Elize Kruger, who's been involved in tracking the BTPI figures.

The average nominal take-home pay in South Africa improved 'significantly' in July, according to the latest BankservAfrica Take-home Pay Index (BTPI).

The index tracks an estimated 4 million salary earners in the country.

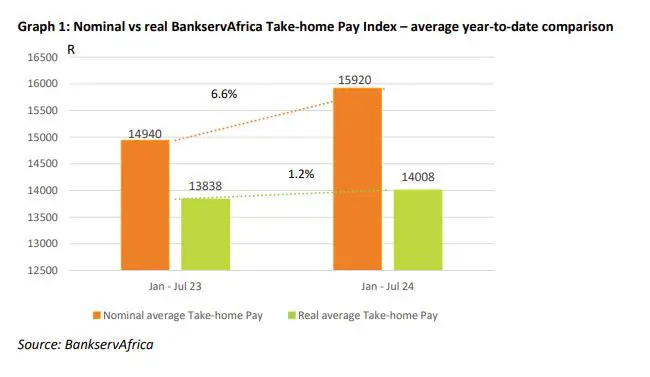

Compared to a year ago, average nominal take-home pay was up 5.9% to reach R16 358.

In real terms, salaries adjusted for inflation tracked higher to R14,440 in July, showing year-on-year growth of 0.9%.

BankservAfrica notes that this encouraging data masks the stark reality that the unemployment rate rose in the first half of 2024, with 73,000 job opportunities lost compared to end-2023.

But, why do those fortunate enough to be salary earners generally say 'it doesn't really feel like it' even if they do actually have more money in their pockets?

Stephen Grootes chats to independent economist Elize Kruger, who's been involved in tracking the BTPI figures.

BankservAfrica salary stats, July 2024

Kruger says we need to take into consideration that we're coming out of three years in which take-home pay did not keep up with inflation.

"Household and salary earners have constantly felt the pressure of being worse off than the previous year and, in the process, debt levels have run up quite a bit. So you may feel rich until you have to start to pay back all sorts of debts that are depleting your salary."

Elize Kruger, Independent Economist

As a result it will take time before we really feel it, Kruger says.

On paper though, she gives the assurance that they have started to see a change in the trend.

"This has been going up and down for a few months meaning it's not a straight line, but so far for 2024 we have seen an uptick in take-home pay as reflected in BankservAfrica's data. And those are actual data points; we're taking the total take-home pay, deposits into bank accounts, divided by the number of salaries."

Elize Kruger, Independent Economist

Scroll up to listen to Kruger's analysis

Get the whole picture 💡

Take a look at the topic timeline for all related articles.