With repo rate unchanged at 8.25%, economists predict cut in late this year

The repo rate has been at 8.25% for more than a year now and remains at a 15-year high.

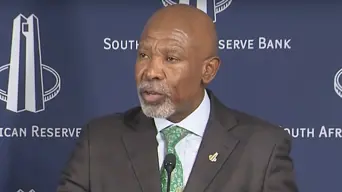

A YouTube screengrab of SA Reserve Bank Governor Lesetja Kganyago delivering the Monetary Policy Committee’s January statement on 25 January 2024.

CAPE TOWN - The move to keep the repo rate unchanged at 8.25% comes as no surprise, as economists have predicted a cut only in September or November.

The prime rate, which is the interest rate that commercial banks charge their clients for loans, will stay at 11.75%.

The repo rate has been at 8.25% for more than a year now and remains at a 15-year high.

The South African Reserve Bank said that inflation was still not at the midpoint of its target range at 4.5%.

However, Reserve Bank Governor Lesetja Kganyago said that the bank expected inflation to stabilise over the medium term.

"We anticipate further progress as inflation slows, helping to re-anchor expectations firmly at 4.5%."

The governor also warned that the battle against inflation was not over.